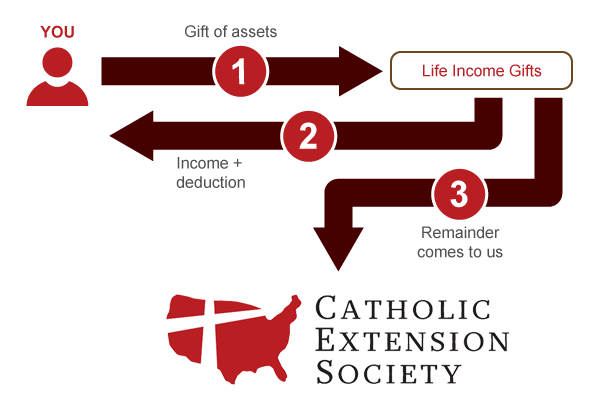

Gifts That Pay You Income

You (or a loved one) can receive an attractive income for as long as you live and make a lasting impact on poor communities of faith across the country.

You can receive fixed payouts for life and help Catholic Extension Society to continue strengthening poor faith communities for years to come.

If you are thinking about this type of gift, we recommend consulting with your financial advisor and with Catholic Extension Society to select an option that is right for you.

Using your Qualified Charitable Distribution for a Charitable Gift Annuity

A “QCD for a CGA” refers to using a Qualified Charitable Distribution (QCD) from an IRA to fund a Charitable Gift Annuity (CGA), meaning you can directly transfer a portion of your IRA funds to establish a CGA, which will then provide you with a set stream of income for life while also making a charitable donation to Catholic Extension Society.

With this type of gift, there are some restrictions:

- You must be at least 70.5 years old to utilize a QCD from your IRA for a CGA.

- The QCD must be the only asset given, no combination of funding assets, or trust additions.

- Payments to annuitants are all ordinary income

- There is no income tax charitable deduction (because you won’t report the distribution as income)

- There is a maximum amount you can contribute from your IRA to a CGA using a QCD, currently capped at around $53,000 per year. The unused portion does not carry forward.

For more information, contact:

Betty Assell

Manager of Annuities

bassell@catholicextension.org

800-842-7804